Latest News

Courier Software News

Mailroom Software News

Popular Posts

What’s Hot

Signed, sealed, delivered.

With decades of industry knowledge, our in-house experts are always on hand to help.

With decades of industry knowledge, our in-house experts are always on hand to help.

With decades of industry knowledge, our in-house experts are always on hand to help.

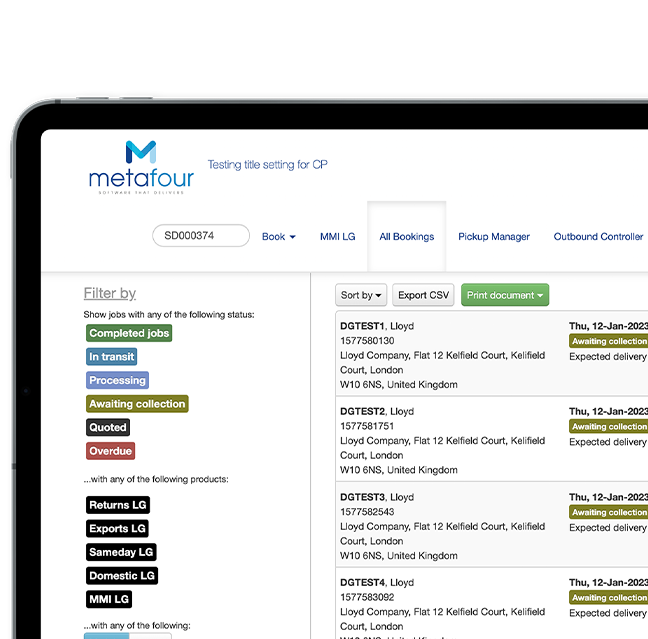

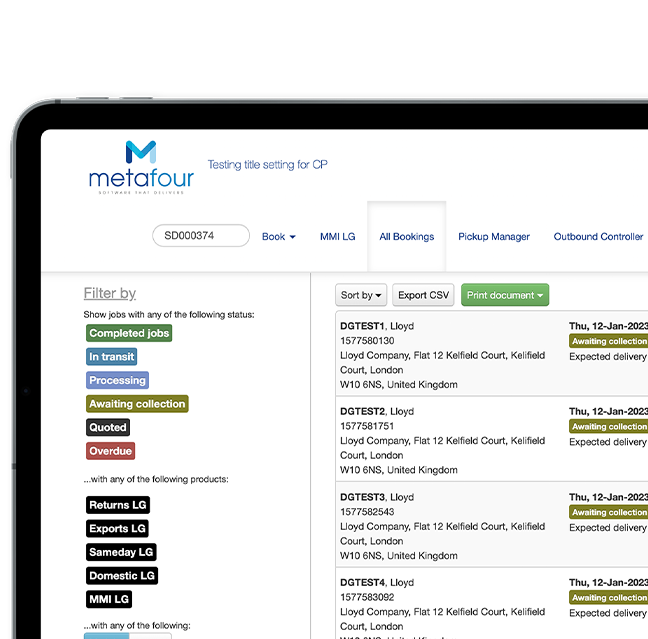

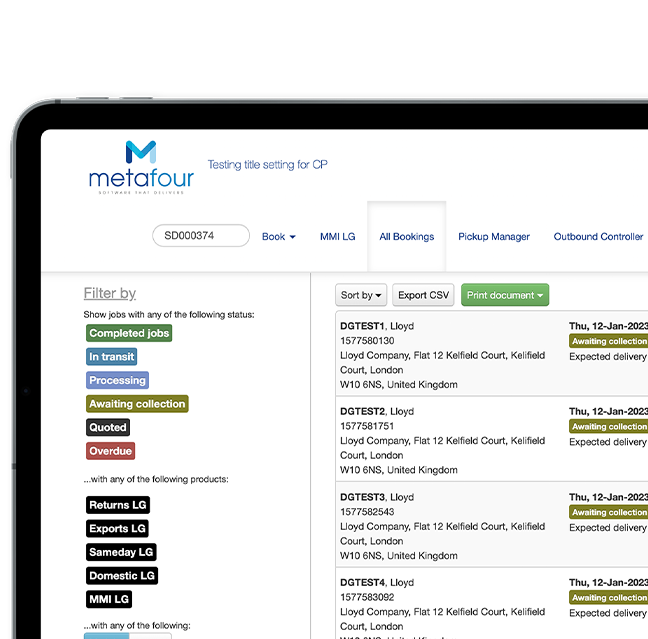

Courier

Industries